Market Dynamics

- Bond Market Fluctuations

- Investor Demand

Dec 20

As you embark on your journey to homeownership, grasping the nuances of mortgage rates can feel like deciphering a complex code. Understanding how these rates fluctuate daily is essential for making informed choices. Let’s delve into the key insights that will empower you in your mortgage journey!

Understanding the forces behind daily mortgage rate changes is crucial. Two main categories, market dynamics and broader economic factors, play significant roles in these fluctuations.

When diving into the world of home loans, understanding how mortgage rates change daily is crucial for making informed decisions. It can feel overwhelming at first, but once you grasp the factors at play, you'll feel much more confident in your home buying journey! Let’s explore what drives these fluctuations and how they might affect you as a borrower.

The movement of mortgage rates is influenced by a variety of factors, primarily stemming from both the bond market and investor behavior. Understanding these elements can help you stay ahead in the competitive mortgage landscape. Here are two key drivers:

As the bond market fluctuates, so do mortgage rates, making it essential to stay informed about current market conditions. Understanding this connection can empower you to time your mortgage applications effectively!

The bond market serves as a primary lever affecting daily mortgage rates. When bond prices increase due to high demand from investors, the interest rates on mortgages tend to decrease. Conversely, if there’s a drop in demand, rates may spike. Keeping an eye on bond market trends is a smart move for anyone looking to buy a home. You can track historical mortgage rates and their correlation with economic indicators through resources like the Federal Reserve Economic Data (FRED).

Investor sentiment plays a significant role in shaping mortgage rates. When there’s a strong appetite for mortgage-backed securities, it can lead to lower rates, benefiting borrowers. On the other hand, reduced interest from investors could result in higher borrowing costs. Thus, if you're in the market for a home, understanding the ebb and flow of investor demand can help you navigate better.

Several economic factors contribute to the variability of mortgage rates. Here are some of the most impactful elements you should be aware of:

By keeping these factors in mind, you can better understand how external conditions may affect your mortgage options.

Inflation is a powerful force that can increase the cost of borrowing. When inflation rises, lenders often react by raising mortgage rates to maintain profitability. This is something to watch closely, especially if you're considering entering the housing market soon! The Consumer Financial Protection Bureau (CFPB) provides valuable insights into how changing mortgage interest rates impact consumers.

The Federal Reserve plays a crucial role in influencing interest rates. When the Fed raises or lowers the federal funds rate, it directly impacts the cost of borrowing. For instance, a rate hike can cool down inflation but also raise mortgage rates, which can affect your home-buying power. For a deeper understanding of the Federal Reserve's monetary policy, refer to reports from the Federal Reserve Board.

As mentioned earlier, mortgage rates are often linked to Treasury yields. When Treasury yields go up, mortgage rates follow suit. This relationship is essential for borrowers to understand, as it can signal potential changes in their mortgage costs.

Economic indicators, such as employment rates and consumer confidence, provide insights into the economy's health. Positive indicators can lead to lower interest rates as lenders feel more confident in lending. Conversely, negative indicators may lead to increased borrowing costs. Staying informed about these trends can empower better decision-making!

Lastly, don’t underestimate the impact of global events on mortgage rates. Natural disasters, geopolitical tensions, and other international issues can create uncertainty that may influence investor behavior and, in turn, mortgage rates. Keeping an eye on global news can provide additional context to your mortgage planning.

How do you stay informed about the fluctuations in mortgage rates? Share your thoughts below:

Understanding the daily fluctuations of mortgage rates can feel overwhelming, but it’s crucial for anyone looking to buy a home. The landscape is constantly changing, and being informed is your best strategy. Let’s explore what you need to know about current and future trends, so you can navigate this journey with confidence!

When it comes to mortgage rates, history often guides our expectations. I recommend keeping an eye on historical trends, as they can provide valuable insights into future movements. Here are a few considerations:

By incorporating these elements into your research, you'll be better equipped to anticipate how mortgage rates may change in the coming months.

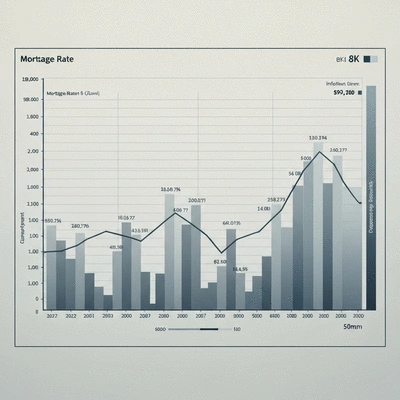

Historically, mortgage rates have fluctuated based on various economic conditions. For instance, during economic downturns, rates often dip to stimulate borrowing, while they may rise during periods of growth as demand increases. It's also important to analyze the impact of inflation on rates.

As we look ahead, experts predict that rates may continue to rise slowly. By keeping informed through reliable financial news outlets and resources, you can make more educated decisions about your mortgage options.

To stay ahead of the game, it's essential to have a strategy for monitoring mortgage rates. Here are a few tips for staying updated:

By taking these steps, you can adapt to market changes with greater ease and make informed decisions.

Staying informed about financial news and economic reports is vital in understanding mortgage rate movements. Key reports to watch include:

By keeping an eye on these reports, you’ll not only enhance your understanding of the market but also empower yourself to time your mortgage decisions effectively!

Now that we’ve covered the nuances of mortgage rate fluctuations, let's dive into actionable steps you can take! Whether you're a first-time homebuyer or considering refinancing, these strategies will help you manage your mortgage rates more effectively.

With so many tools available, it’s essential to leverage resources that can guide your decision-making process. Here are a few effective resources to consider:

These tools will make it easier for you to determine your options and find the best mortgage solution for your financial situation.

Interactive tools can be a game-changer when it comes to managing your mortgage. By using these resources, you can:

These tools not only save you time but also provide clarity as you navigate your mortgage options.

Sometimes, the best way to ensure you’re making informed decisions is to seek professional guidance. At MBM Home Loans, we are here to help you find personalized strategies that suit your needs. Whether you’re curious about locking in rates or exploring refinancing options, our experts can provide tailored advice.

Don't hesitate to reach out! We’re passionate about empowering homeowners like you to make informed decisions.

Finally, it's crucial to know the ins and outs of the pre-approval process. This step can give you a significant advantage as you explore mortgage options. Here’s what you need to know:

By understanding and completing the pre-approval process, you’re setting yourself up for success in your home-buying journey!

Here is a quick recap of the important points discussed in the article: